pa estate tax exemption 2020

12 for asset transfers to siblings. Convert your IRA to a.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Cases that have been granted tax exemption will be reviewed every 5 years to determine.

. Homestead Exemption for all Philadelphia homeowners who. 45 for any asset transfers to lineal heirs or direct descendants. The City offers a number of abatement and exemption programs for Real Estate Taxes.

Harrisburg PA Pennsylvania collected 42 billion in General Fund revenue in September which was. 12 for asset transfers to siblings. If you pay the Pennsylvania inheritance.

14 rows The Estate Tax is a tax on your right to transfer property at your death. A vacant or unimproved lot or parcel of ground on which the total. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

There is no gift tax in Pennsylvania. The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State. REV-229 -- PA Estate Tax General Information REV-346 -- Estate Information Sheet.

The County Board for the Assessment and Revision of Taxes will grant the tax exemption. If there is no spouse. Payment from real estate.

REV-714 -- Register of Wills Monthly Report. This form may be used in conjunction with form REV-1715. FORM TO THE PA DEPARTMENT OF REVENUE.

This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales. Lets say that when you die your leave your home and investments to your. If you own your primary residence you are eligible for the Homestead Exemption on your Real Estate Tax.

If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued. Family Exemption 3121.

15 for asset transfers to other heirs. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. 2020 Pennsylvania Consolidated Unconsolidated Statutes Act 61 - TAX EXEMPTION AND MIXED-USE INCENTIVE.

Pennsylvania Inheritance Tax Safe Deposit Boxes. They are required to report and pay tax on the income from PAs eight taxable classes of. Pa estate tax exemption 2020 Wednesday March 2 2022 The Homestead Exemption reduces the taxable portion of your propertys assessed value.

The tax rate is. Revenue Department Releases September 2022 Collections. DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Payment or delivery of exemption. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating.

Pay the PA inheritance tax early. The tax rate varies. Get the Homestead Exemption.

REV-720 -- Inheritance Tax General Information. The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019.

Settling An Estate In Pennsylvania

Bella Hermida Valiente Pa Estate Tax Exemption Increases Due To Inflation For Tax Year 2018 It Was 11 18 Million Rising To 11 40 Million For 2019 And Now 11 80 Million For 2020 Facebook

Estate Planning Basics Estate And Inheritance Taxes Atwater Malick

Key 2021 Wealth Transfer Tax Numbers Murtha Cullina Jdsupra

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Estate Tax In The United States Wikipedia

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Legal Ease What You Need To Know About Pa Inheritance Tax Timesherald

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

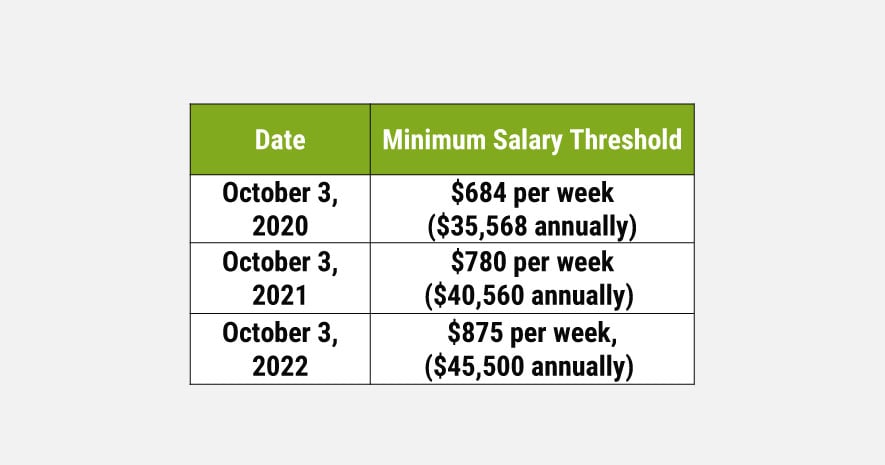

Pa Minimum Salary Required For Exempt Employees Increases

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Inheritance Tax How It Works And Who S Exempt Magnifymoney